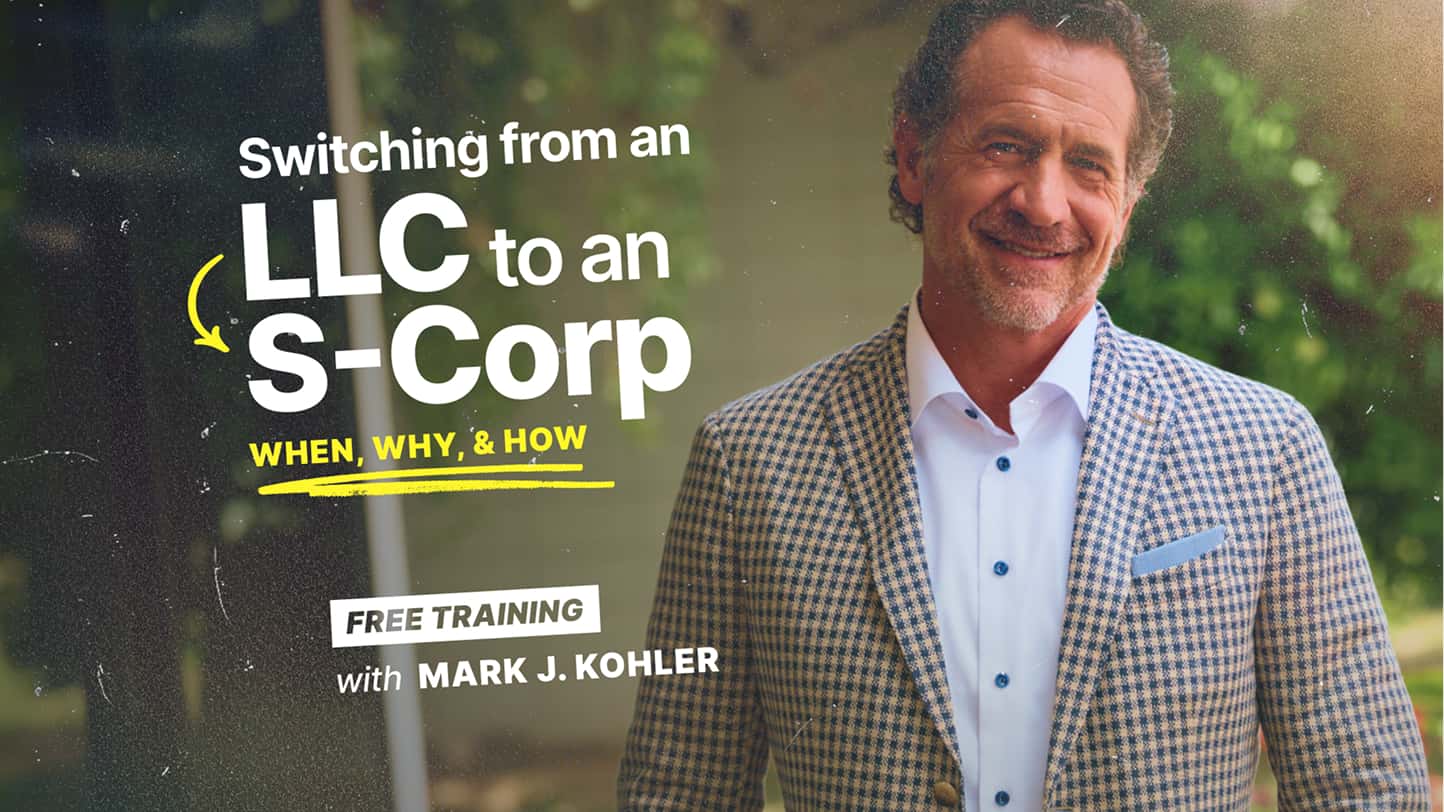

Tax Advisors Playbook: How To Move Your Client From An LLC To An S-Corp

Ready to level up your tax practice and deliver exceptional client value?

If your clients are making $40k+, an LLC taxed as a sole prop might be costing them thousands. Most small business owners don’t realize how much they could save with the right business structure. You can be the advisor who shows them.

In this free 25-minute training, Mark J. Kohler gives you the practical, step-by-step guide to transitioning clients from an LLC to an S-Corp—without complexity or confusion.

What you’ll learn:

- The exact steps to file and elect S-Corp status

- How to calculate a reasonable salary

- How to communicate the strategy and savings clearly

- Tips for charging more for your valuable service

Featured In

Complete the form to check out this comprehensive 25-minute video with Mark J. Kohler and master the art of transitioning an LLC to an S corporation.